Colocation Take-Up In 2020 To Fall Below 2019 In Europe’s FLAP Market

Colocation take-up is predicted to decrease in 2020 due to Frankfurt and London having their best years in 2018 and 2019.

Amsterdam’s data centre moratorium is another factor that is set to stunt the growth of take-up next year, which will have the potential to bring the numbers down lower than those of 2019, according to newly released figures from CBRE.

Colocation take-up comprises data centre space sold at retailer and wholesaler colocation facilities in the relevant quarter.

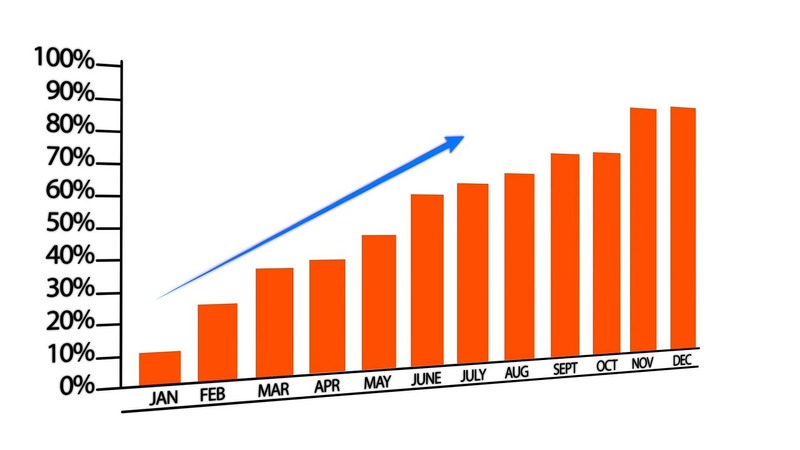

However, in the same breath, the figures predict that the four largest European colocation FLAP markets of Frankfurt, London, Amsterdam and Paris are set for a record-breaking finish to 2019, with a “supercharged” last quarter, as enterprise demand in the FLAP markets has increased in the years since 2016.

According to the findings, there was 38MW of take-up and 63MW of new supply across the four markets during Q3.

London and Frankfurt were particularly strong on the demand side, and Amsterdam was responsible for nearly 50% of the new supply. CBRE forecasts that market activity in Q4 will double that of Q3 to create a record year.

Europe is at the centre of the largest data centre M&A transaction on record as Digital Realty announces its intention to acquire Interxion for $8.4bn.

This transaction will combine two of the largest and longest-standing European colocation providers, and in an era of aggressive consolidation across Europe, this transaction stands out in both capital value and footprint terms, according to CBRE.

“These record levels of development underway in the major European markets are creating challenges,” said Mitul Patel, Head of EMEA Data Centre Research at CBRE.

“The availability of freehold land in popular data centre hubs, which offer proximity to large amounts of HV power and fibre routes, such as Slough in the UK and Schiphol in Amsterdam, is highly constrained.

“The effects of these barriers to entry are that data centre developers are either choosing to locate in new, sometimes unproven, locations or are competing aggressively on price for land opportunities.

“Despite cloud providers driving market activity, enterprise demand for colocation remains consistent across the major markets.

“CBRE analysis shows that in the four years from 2016, there has been an average of 43MW of enterprise take-up per year across the four FLAP markets.

“As enterprise companies continue to utilize colocation footprints as part of their hybrid IT architecture, we expect this to remain consistent.”

In August this year, the collective take-up of colocation capacity across Europe’s four major datacentre hubs hit record highs in the first six months of 2019, despite a marked slowdown in London, according to CBRE.

Since then, there has been 136MW of take-up in the first three quarters of 2019 across the FLAP markets of Frankfurt, London, Amsterdam and Paris.

Full-year take-up is forecast to surpass 200MW for the first time in history, and CBRE has predicted a further 150MW of new supply in Q4 alone, which would see the year surpass 300MW in new colocation capacity.

By year-end 2019, CBRE forecasts that cloud companies will have been responsible for 80% of the take-up across the four FLAP markets for the second-consecutive year.

source dataeconomy

Industry: Data Centre / Data Center