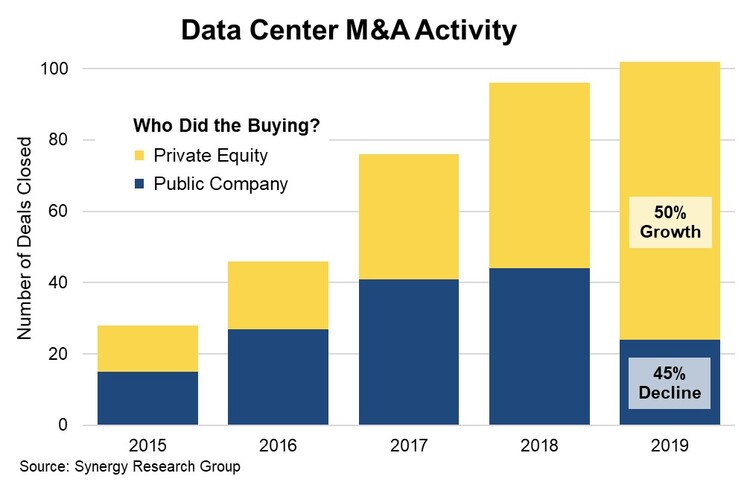

Data Center M&A Deal Volume Up in 2019 Thanks to Big Jump in Private Equity

New data from Synergy Research Group shows that in 2019 the number of data center-oriented M&A deals closed passed the 100 mark for the first time. This was up 6% from 2018 and more than double the numbers of deals closed in 2016. Over the last five years almost 350 deals have closed. One radical change in 2019 was the dramatic 50% increase in private equity deals, which more than offset a sharp 45% drop in M&A deals closed by public companies. While deal volume increased in 2019, the aggregate value of those deals declined due to a 24% reduction in average deal value, continuing a trend seen in 2018. 2017 marked a peak in average deal values thanks to three multi-billion dollar deals and three more valued at over a billion dollars each. The number of billion-dollar deals declined in 2018 and again in 2019.

Since the beginning of 2015 Synergy has identified 348 closed deals with an aggregated value of $75 billion. Over the five-year period the aggregated deal value has been split roughly equally between public companies and private equity buyers, while private equity buyers have accounted for 57% of the deal volume. Since 2015 the largest deals to be closed are the acquisition of DuPont Fabros by Digital Realty, the Equinix acquisition of Verizon’s data centers and the Equinix acquisition of Telecity. Over the 2015-2019 period, by far the largest investors have been Digital Realty and Equinix, the world’s two leading colocation providers. In aggregate they account for 31% of total deal value over the period. Digital Realty also has a pending deal to acquire Interxion, in what would be the largest ever data center transaction. Other notable data center operators who have been serial acquirers include CyrusOne, Iron Mountain, Digital Bridge/DataBank, NTT, GI Partners, Carter Validus, GDS, QTS and Keppel.

“The aggressive growth of cloud services and outsourcing trends more generally are fueling a drive for scale and geographic reach among data center operators, which in turn is stimulating data center M&A activities,” said John Dinsdale, a Chief Analyst at Synergy Research Group. “This has been attracting an ever-increasing level of private equity activity as investors seek to benefit from high-value and strategically important data center assets. It is also notable that even the biggest publicly traded data center operators are increasingly turning to joint ventures with external investors to help fund growth and protect balance sheets.”

source srgresearch

Industry: Data Centre / Data Center